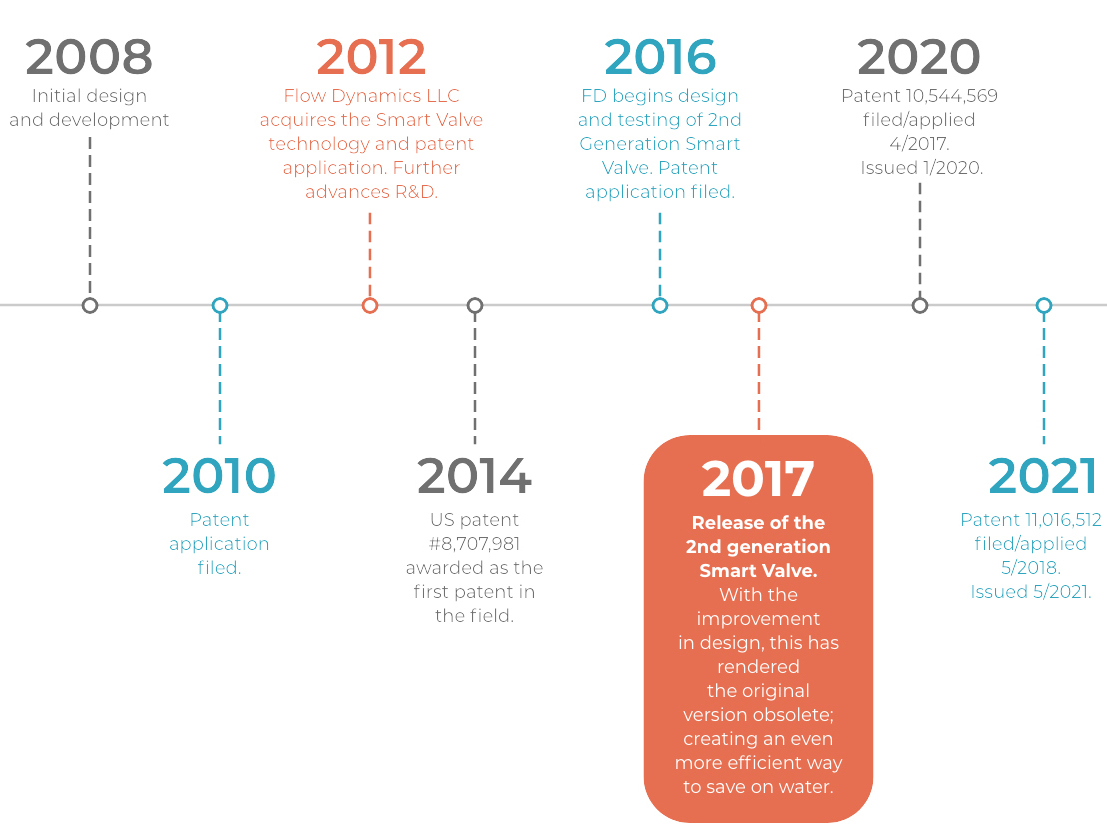

Since our foundation, we’ve been at the forefront of valve technology. We know from experience that our first-generation Smart Valves, while efficient and reliable, are no longer the leading edge in Smart Valve design. That’s why trusting advice about Smart Valves from anyone other than experts like us is ill-advised. Only a qualified source can provide you with the information necessary to make an informed decision. So, listen up.

Don’t fall victim to outdated first-generation valves.

Say goodbye to the days of first-generation valves — it’s time for an upgrade. Our most recent valve installments boast externally adjustable flow management, allowing users to calibrate their valves while water continues to run. This technology is far superior to any of its predecessors as it reduces risk and allows you to obtain the best possible results. Plus, it has three times the flow capacity – meaning it will work in the widest range of conditions.

First-generation Smart Valves aren’t worth the hassle.

All these added features make the first generation of Smart Valves outdated and obsolete. The next generation of valves have proven to make operations stronger, more reliable, and more efficient than ever before.

Introducing the next generation of Smart Valve technology

The Benefits of the 2nd Generation Smart Valve:

- One-time Installation – The 2nd Generation Smart Valve™ is externally adjustable. Once installed it can be quickly and easily adjusted without ever needing to turn off the water or remove the device. Saves time, money and avoids future interruption of water delivery.

- Adjustable – The Smart Valve™ now has a wide range of effect settings – from ‘zero effect’ to ‘maximum effect’ and all points in between. The valve is delivered and installed at or near the ‘zero’ setting, where it has little or no effect. Once the water is turned back on, the valve is adjusted to the perfect setting for the system.

- Adaptable – In the future, if the system pressure or flow rate changes up or down the Smart Valve can be quickly and easily adjusted to maintain maximum savings without the need to interrupt service.

- Greater Flow Rates – Other flow management valves are often designed to slide inside the pipe in flanged versions, or are male threaded pipe sizes, resulting in reduced interior diameter within the existing pipe, and lowered maximum flow rate. The 2nd Generation Smart Valve™ is either double flanged (3-inch and larger) or female threaded (2-inch and smaller). Allowing for a much larger interior diameter and no loss in flow capacity.

- Highly Visible – The 2nd Generation Smart Valve™ is installed on the outside of the water line, ensuring facility personnel and plumbers can easily find and adjust it if necessary. Other flow management valves are installed inside the water pipe, making it difficult to locate if needed.

- Fully Certified – Our 2nd Generation Smart Valve™ is designed with high-quality materials and precision manufacturing and is covered by NSF 61 and NSF 372 certifications

The Benefits of the 3rd Generation Smart Valve:

The 3rd Generation Smart Valve has all the same benefits as the 2nd Generation, PLUS:

- Greater Flow Capacity – The 3rd Generation Smart Valve™ has nearly THREE TIMES the capacity of any previous design!

- More Adjustable – The Smart Valve™ now has an even wider range of effect settings to ensure that we can find the PERFECT setting for every system.

- Ease of Calibration – Whereas the 2nd Generation requires a little muscle to adjust it, the 3rd Generation Smart Valve can be calibrated with the strength of a fingertip.

More about Smart Valve™

The Smart Valve™ takes long established principles of pressure and fluid dynamics, such as Boyle’s Law regarding gas pressure and volume, and Le Chatelier’s Principle of volumetric dynamics, and applies them in a new and financially rewarding application. We understand the physics of water and have applied that understanding to create a product that saves our customers money and water!

How The Smart Valve™ Works

Air Compression

The Smart Valve™ constantly adjusts to downstream demand, while MAINTAINING as near city (static) pressure UPSTREAM past the water meter. By not allowing pressure to drop upstream, it prevents air volume from expanding due to the typical pressure drop created by water demand. The volume of air passes by the water meter in this compressed state until after it passes through the Smart Valve™ and soon returns to its original lower pressure state. The Smart Valve™ eliminates the excess volume of air at the point of water meter measurement, ensuring a lower meter reading but not impacting the pressure of water coming into the facility.

Flow Stabilization

Water meters are designed to be accurate within a specific flow range. If the flow exceeds this range, it can cause the metering to overread consumption. This is especially true during a surge as can happen by variability in the municipal water supply or by moving from a static to dynamic water flow. The Smart Valve’s™ proprietary variably adjusting technology eliminates these peaks and valleys, creating a smooth, even flow that keeps your meter readings more accurate and protects against damage that can occur from a surge.

Reduced Consumption

An effect of creating backpressure upstream is a corresponding pressure drop downstream. The Smart Valve™ can precisely control the amount of pressure drop based on individual system needs. This pressure drop reduces actual water consumption in non-volumetric water uses such as showers, sinks, hoses and the like, adding up to meaningful water bill savings.

Pressure Reduction

Almost all water devices are designed for approximately 60-65 psi water supply. A higher psi can cause excessive water delivery, as well as undetected leaks at seals and gaskets. A pressure reducer can help this by maintaining a 60-65 psi into the facility. Unfortunately, these devices require maintenance and often fail. The Smart Valve™ is a reliable back-up, as it can achieve a significant pressure reduction in high-PSI water systems, reducing the problems caused by excessive water pressure.

Other Benefits

By virtue of its design the Smart Valve™ acts as a secondary back flow preventer to protect the municipal water supply. This is becoming more and more important as municipalities seek to better protect our water reserves from contamination.

How It Works

Visual Bubble Test

Our Guarantee

The Smart Valve™ has been proven to save our customers money and water. It works 24/7/365 with no maintenance needed. It enables our customers to set it and forget it. The only difference noticed is reduced water and sewer bills! We are very confident in the benefits, such that we offer all customers a money back guarantee if they don’t achieve the results we agree upon at the beginning of each new project.

Your One Stop Solution

- Keeps the water line pressurized at the meter to avoid being charged for air volume.

- Keeps your flow rate in the desired range for additional water meter accuracy.

- Reduces excessively high water pressure.

- Eliminates over consumption due to high pressure.

- Conserves water, especially in facilities without pressure reducers or flow regulators.

- Acts as a shock absorber against pressure surges and drops.